In a surprising turn of events, the mortgage market has experienced a significant shift as mortgage rates soar to their highest point since the year 2000. This abrupt increase has left prospective homebuyers, current homeowners, and industry experts alike grappling with its potential implications and trying to make sense of the underlying factors driving this trend.

The Surge in Mortgage Rates.

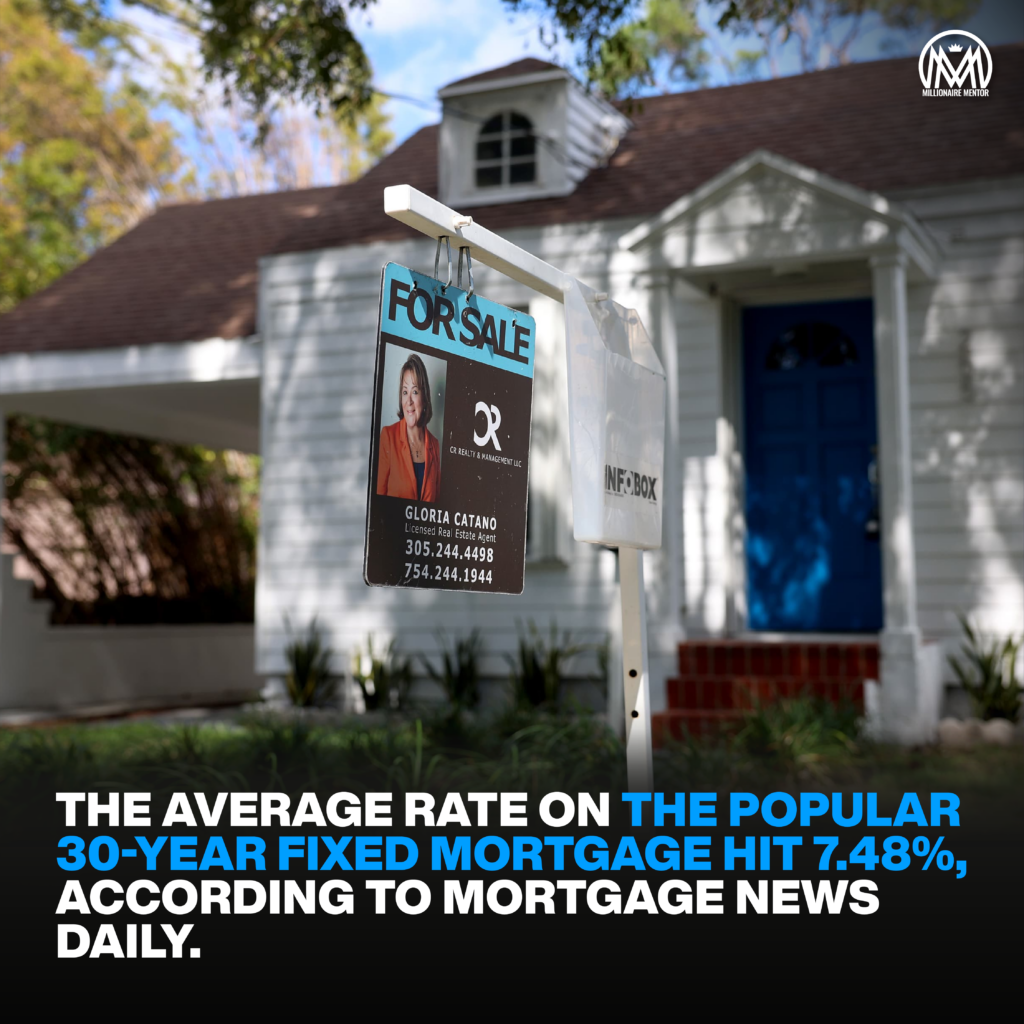

Over the past few months, mortgage rates have undergone a rapid ascent, catching many by surprise. As of now, the average 30-year fixed-rate mortgage has reached a level not seen in over two decades. The spike has taken rates well beyond the relatively stable range they have occupied for several years.

Factors Driving the Increase.

Several interconnected factors have contributed to the recent surge in mortgage rates:

Economic Recovery and Inflation Concerns: The global economy has been on a path to recovery, with many countries rebounding from the impacts of the pandemic. This has led to concerns about inflation as demand for goods and services increases. Central banks have responded by signaling potential interest rate hikes to curb inflation, indirectly affecting mortgage rates.

Central Bank Policies: The actions of central banks, including the Federal Reserve in the United States, play a critical role in determining interest rates. As central banks pivot toward tighter monetary policy to address potential inflationary pressures, the effect cascades down to various lending rates, including mortgages.

Housing Market Dynamics: The housing market has been experiencing high demand and limited supply for some time. This has put upward pressure on home prices, making it more expensive to purchase a home. The increased demand for mortgages combined with limited housing supply has likely contributed to the upward movement in rates.

Global Economic Landscape: The interconnectedness of economies in today’s world means that global events can have a significant impact on local markets. Geopolitical tensions, supply chain disruptions, and changes in trade dynamics can all influence interest rates.

Implications for Homebuyers and Homeowners.

The ramifications of these rising mortgage rates are far-reaching:

Affordability Challenges: Higher mortgage rates directly impact the affordability of homes. Prospective homebuyers might find themselves facing increased monthly payments, potentially pricing some out of the market or necessitating a reevaluation of their purchasing decisions.

Refinancing Slowdown: With rates climbing, the trend of homeowners refinancing their mortgages to take advantage of lower rates is likely to slow down. This might impact consumer spending patterns and the broader economy.

Real Estate Market: The real estate market could experience a cooling effect due to reduced affordability. Slower sales and potential downward pressure on home prices might become evident in the coming months.

Investment Landscape: As borrowing costs rise, real estate investors might need to adjust their strategies. This could lead to shifts in demand for certain types of properties and investment opportunities.

Navigating the New Landscape.

For those considering entering the housing market or seeking to refinance, a proactive approach is crucial. Exploring different mortgage options, consulting with financial advisors, and carefully assessing personal financial situations will be essential in making informed decisions.

Industry players, including mortgage lenders, real estate agents, and economists, will be closely monitoring the situation and adjusting their strategies to align with the evolving market dynamics.

The recent surge in mortgage rates to levels not seen since 2000 has set off a series of reactions across the housing and financial sectors. While challenges in affordability and investment strategies are expected, proactive and informed decision-making can help individuals and businesses navigate this new landscape with resilience.

Trending News Articles

Bitcoin-Holder MicroStrategy’s X Account Hacked: Security Firmby Jason Stone●February 26, 2024

Bitcoin-Holder MicroStrategy’s X Account Hacked: Security Firmby Jason Stone●February 26, 2024 Amazon builds $120 million satellite processing hub in Florida.by Jason Stone●July 22, 2023

Amazon builds $120 million satellite processing hub in Florida.by Jason Stone●July 22, 2023 The two most important days in your life!by Jason Stone●January 10, 2023

The two most important days in your life!by Jason Stone●January 10, 2023 Peter Doocy DROPS THE MIC On Karine Jean-Pierre With ONE Simple Factby Jason Stone●December 17, 2023

Peter Doocy DROPS THE MIC On Karine Jean-Pierre With ONE Simple Factby Jason Stone●December 17, 2023